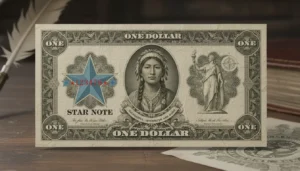

Sacagawea Dollar vs Star Note: Market Overview

Collectors and investors often look at both Sacagawea dollars and star notes as short-term plays or long-term holds. Each category has different drivers of value, so deciding which will surge by 2025 requires a clear checklist.

This guide explains the key factors, practical steps for evaluation, and a short case study to illustrate how real-world outcomes can differ.

What drives value for Sacagawea Dollar vs Star Note

Two broad forces shape value in both markets: supply side factors like rarity and survival rate, and demand side factors like collector interest and historical significance. Knowing how these forces apply to Sacagawea dollars and star notes helps predict near-term price movement.

Key Factors for Sacagawea Dollar Value

Sacagawea dollar values depend heavily on minting year, variety, and condition. Early business strikes and known varieties attract collectors.

Watch these specific factors:

- Rarity and mintage numbers: Low mintage dates and proof sets are more valuable.

- Mint errors and varieties: Doubled dies, planchet errors, and unique packaging command premiums.

- Grade and eye appeal: High-graded MS or PR coins sell significantly higher than worn pieces.

- Provenance: Coins with clear pedigrees or auction history can fetch more.

Practical grading and authentication tips for Sacagawea Dollar

Always seek third-party grading for high-value pieces. Check population reports to understand how many specimens exist at each grade.

Use a loupe and compare to verified photos of known varieties before buying or selling.

Key Factors for Star Note Value

Star notes are replacement currency printed to replace defective sheets. They are sought after because fewer are issued compared to regular notes.

Important value drivers include:

- Series and denomination: Some series produced fewer star notes and become more collectible.

- Condition and centering: Crisp, uncirculated star notes bring top dollar.

- Serial number patterns: Low numbers, radar, or repeaters add value.

- Authentication: Professional grading with UV and fold tests matters for higher-priced sales.

Practical tips for evaluating star notes

Check the star at the end of the serial number and confirm it is genuine. Use currency price guides and recent auction results to set realistic expectations.

Photo-document any suspect notes and consider third-party currency grading for expensive pieces.

Star notes are printed specifically as replacements, which is why their serial numbers include a star. Some U.S. star notes have appreciated more than common commemorative coins due to low supply and high collector interest.

Comparing Short-Term Upside: Sacagawea Dollar vs Star Note

Short-term gains through 2025 depend on market sentiment, auction activity, and availability of quality pieces. Star notes can see quick spikes when a rare serial pattern appears in high grade.

Sacagawea dollars typically gain steadily for rare varieties or error coins, but broad market moves depend on collector enthusiasm.

Which is more likely to surge by 2025?

If you expect a sudden collector trend or online spotlight on banknotes, star notes may outpace Sacagawea dollars briefly. If grading services continue to uncover overlooked coin varieties, certain Sacagawea issues could outperform.

Checklist to Decide Where to Invest

Use the following checklist to evaluate a specific coin or note before buying:

- Is the piece authenticated or graded?

- What is the known mintage or estimated survival rate?

- Are there comparable recent auction sales?

- Is the piece desirable to both collectors and investors?

- What are storage and insurance costs for the item?

Practical buying tips

Buy from reputable dealers or auction houses. Keep receipts and condition reports. For star notes, handle with gloves and store in inert sleeves to maintain grade.

Small Real-World Case Study

A hobbyist found a well-centered Sacagawea dollar variety at a coin show and a crisp star note lot from estate currency. The collector chose to authenticate both items and listed them separately on an auction platform.

The star note lot received quick interest from currency collectors and sold within two weeks, while the Sacagawea variety took longer but sold to a specialized coin dealer at a higher per-item margin. The outcome illustrated that liquidity and buyer pools can differ significantly between coins and notes.

Action Plan: How to Position Your Collection by 2025

Follow a simple plan to increase the chance your holding will surge in value:

- Research current auction results monthly for target series.

- Grade high-potential pieces and keep documentation.

- Diversify between a few star notes and a few Sacagawea varieties to spread risk.

- Monitor online forums and social media for sudden collector interest shifts.

Final practical guidance

Neither category guarantees a surge by 2025. Short-term gains are often event-driven. Prioritize authentication, quality, and market awareness to maximize your chances.

Use the checklist above and start with a small, well-documented purchase to learn the market dynamics before scaling up.