Investors who collect currency and coins often face a choice: focus on star notes or rare coins. Both categories have dedicated markets and unique risks. This guide explains the practical differences and why some investors prefer one over the other.

Star Notes vs Rare Coins: Quick Comparison

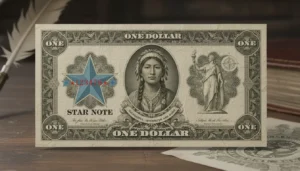

Star notes are replacement banknotes printed to replace misprinted serial numbers. They carry a small star symbol in the serial number and are usually modern, low-denomination notes that survived in good condition.

Rare coins are struck metal currency items that are valued for age, rarity, mint errors, or historical significance. They range from relatively common collectible issues to one-of-a-kind rarities with very high values.

Key features of star notes

- Often modern and easier to find in higher grades.

- Lower entry cost for many examples compared with high-end rare coins.

- Popular with currency collectors and beginner investors seeking accessible collectibles.

Key features of rare coins

- Wider price spectrum, from small premiums to multi-million-dollar rarities.

- Heavily influenced by grading, provenance, and market trends.

- Often requires deeper numismatic knowledge and secure storage.

Why investors choose star notes

Liquidity and affordability make star notes attractive to many small investors. A well-preserved star note from a popular series can be sold quickly to collectors online or at currency shows.

Star notes are also easier to grade and authenticate, with fewer complex stylistic variations than coins. That simplicity lowers the barrier for new investors learning grading scales and market values.

Practical advantages

- Smaller investment amounts let you build a diversified collection without large capital.

- Lower storage and insurance costs compared with high-value coins.

- Strong collector community and steady secondary markets for common star note series.

Why investors choose rare coins

Rare coins are often chosen for long-term appreciation potential and historical value. Investors seeking significant upside often target coins with limited surviving populations or important provenance.

High-end rare coins benefit from established grading services and auction houses that set transparent price references over time. That infrastructure can make high-value transactions more secure.

Practical advantages

- Potential for larger absolute returns on landmark pieces or error coins.

- Strong institutional support from grading services like PCGS and NGC.

- Collectible and aesthetic appeal to museums and serious collectors.

Factors that influence investor preference

Several objective factors shape whether an investor leans toward star notes or rare coins. Evaluate these before buying:

- Budget: Star notes allow entry at lower price points than many rare coins.

- Liquidity needs: Smaller, common star notes sell more quickly in online marketplaces.

- Risk tolerance: Rare coins can be volatile and require waiting for the right buyer at the right price.

- Storage and insurance: High-value coins need secure storage; star notes usually cost less to protect.

- Expertise: Coins often require deeper numismatic study; star notes are more straightforward for new collectors.

Practical buying advice for investors

Whether you prefer star notes or rare coins, follow practical steps to reduce risk and improve returns. Use reliable grading services, buy from reputable dealers, and document provenance.

Keep these tips in mind when building your collection:

- Buy graded pieces when possible to limit disputes about condition.

- Compare auction results and price guides to establish fair values.

- Diversify across series or types to avoid concentration risk.

- Keep clear records for insurance and potential tax reporting.

Storage and insurance considerations

Store star notes flat in archival sleeves and keep coins in airtight holders. High-value coins should be stored in a safe deposit box or insured private vault.

Insurance costs rise with value, so factor them into expected holding costs for rare coins more than for typical star notes.

Star notes originally indicate replacement notes used by mints when serial numbers are misprinted. That small star mark can increase collector interest and resale value, especially in high-grade examples.

Case study: A modest investor’s choice

Alex, an investor with a $5,000 collectible budget, wanted a mix of stability and upside. He split the money: 60 percent into graded star notes from popular modern series, and 40 percent into two certified vintage coins with solid pedigrees.

The star notes provided easier liquidity and steady small gains at local shows and online auctions. The vintage coins required longer holding time, but one coin gained notable premium after a grading upgrade and sold at auction for a profit.

Alex’s strategy shows how combining star notes and rare coins can balance short-term liquidity with long-term appreciation potential.

Final decision framework: Which to prefer?

Choose star notes if you want lower entry cost, easier grading, and quicker sales. They are suitable for beginners and investors wanting broad exposure to currency collecting.

Choose rare coins if you seek higher upside, enjoy numismatic research, and can accept slower liquidity and higher storage costs. Rare coins suit experienced collectors and investors targeting long-term capital appreciation.

Many investors do both. A diversified approach across star notes and coins can reduce risk and capture different market opportunities.

Before making purchases, set clear goals, educate yourself on grading and market trends, and work with reputable dealers or auction houses to protect your investment.